Europe’s AI Powerhouse: SAP Secures 85% of 2026 Revenue as AI Deals Skyrocket

While the global enterprise AI landscape is often dominated by U.S. giants like Microsoft and Salesforce, Europe’s SAP is rapidly emerging as a powerful contender — and it’s betting big on artificial intelligence.

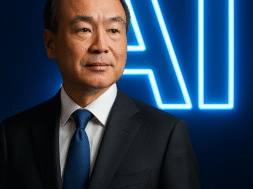

In a recent interview, SAP CEO Christian Klein revealed that AI is now the top driver behind new client contracts, fueling impressive growth momentum across its cloud and enterprise platforms.

“After closing Q4, nearly 85% of our 2026 revenue is already locked in,” Klein stated confidently, adding that the company’s robust deal pipeline ensures a strong close to the fiscal year.

SAP’s Cloud & AI Surge

SAP reported that its cloud backlog jumped 23% in the third quarter, reaching €18.8 billion, while total revenue climbed 7% to €9.08 billion ($10.53 billion). Although slightly below market forecasts, cloud-based revenue surged 22% year-over-year, highlighting SAP’s growing dominance in AI and data-driven services.

Deutsche Bank analysts maintained SAP as a “top pick” in European and global software, acknowledging that while deal closures have been slower, SAP continues to deliver consistent execution and remains on track for FY25 growth.

Europe’s AI Momentum

Earlier this year, SAP briefly became Europe’s most valuable company, buoyed by investor optimism around AI-driven transformation and strong German market performance.

However, Europe’s AI strategy remains under debate, with industry leaders questioning whether the EU’s cautious regulatory stance can match the U.S.’s more flexible “build, test, and optimize” approach.

Klein emphasized that SAP’s focus is not on hype but real-world AI adoption and measurable value — the factor most sought after by enterprise clients.

“The goal isn’t just to chase trends but to ensure that AI drives tangible impact for businesses,” Klein explained.

Strategic Global Positioning

SAP continues to strengthen its global footprint, including a strategic “in China, for China” approach that allows it to operate locally amid geopolitical complexities. Klein acknowledged that China’s AI growth, minimal regulatory barriers, and talent pool make it an essential market in SAP’s long-term vision.

Having restructured in 2024 to pivot toward AI-first solutions, SAP now delivers integrated systems for finance, supply chain, and expense management, empowering enterprises with smarter, automated insights.

Looking Ahead

With AI integration at its core, SAP’s growth trajectory signals a new era for Europe’s tech landscape. As businesses increasingly shift toward AI-powered operations, SAP’s proactive transformation positions it as Europe’s best hope to rival American AI dominance.

“Training AI models is becoming a commodity — applying them effectively is where the real value lies,” Klein concluded.