Tesla Misses Earnings, Meta Slashes Jobs, and U.S. Tightens Oil Sanctions on Russia — Your Morning Market Brief

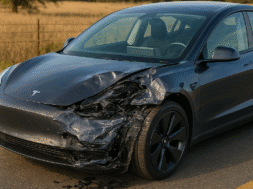

1. Tesla Hits a Speed Bump

All eyes were on Tesla yesterday as it kicked off the new earnings season among the “Magnificent Seven” tech giants. Despite a slight recovery in revenue after two declining quarters, earnings per share fell short of market expectations due to rising capital expenditures.

During the company’s earnings call, Elon Musk and his team focused more on robotics and AI innovation—including the Robotaxi project and Optimus humanoid robots—rather than the auto segment. Musk hinted at Tesla’s progress in developing its own AI chips, but admitted the company is “not replacing Nvidia anytime soon.”

Meanwhile, investor pressure is mounting over Musk’s proposed massive compensation package, which could grant him nearly $1 trillion in stock value. Musk criticized opposition from proxy advisors, referring to them as “corporate terrorists.”

Following the call, Tesla shares dropped over 3% in premarket trading as investors digested the mixed results and leadership remarks.

2. Airlines Soar Above Expectations

In contrast, Southwest Airlines exceeded forecasts on both revenue and earnings, managing to post a profit where analysts had expected a loss. However, shares still slipped by around 1% before the market opened.

American Airlines also reported strong quarterly results and issued an upbeat forecast for the remainder of the year, leading to a 4% jump in share prices. Next on the airline radar: Alaska Airlines will release its earnings later today.

3. Oil Prices Surge on New Russia Sanctions

The White House has imposed additional sanctions on Rosneft and Lukoil, Russia’s top two oil companies, citing the country’s failure to commit to peace negotiations regarding the Ukraine conflict.

The move triggered a sharp 5% rise in Brent crude oil prices, underscoring how geopolitical tensions continue to influence energy markets. Treasury Secretary Scott Bessent warned that further actions could follow if the situation remains unchanged.

4. Meta Cuts 600 Jobs in AI Division

While the tech world races to expand AI capabilities, Meta has taken a different route — laying off around 600 employees from its artificial intelligence division.

Insiders described the move as part of efforts to streamline operations within what they called an “overextended” AI unit. However, no staff from TBD Labs, the division housing many of Meta’s top AI hires, are affected.

At the same time, several prominent tech leaders, including Richard Branson and Steve Wozniak, are calling for a temporary pause in developing “superintelligent AI” systems, citing safety and ethical concerns.

5. Starbucks Faces Strike Threat

Breaking this morning — Starbucks Workers United has announced plans to begin voting on a nationwide strike authorization. The union also plans rallies and demonstrations alongside allied groups.

Negotiations between the company and the union remain stalled, with workers demanding higher pay, fairer schedules, and resolution of ongoing labor disputes. Starbucks, in response, stated it is open to returning to the table if the union resumes talks.

The coffee chain is set to report its quarterly results next week, and investors will be closely watching how the labor unrest might impact performance.