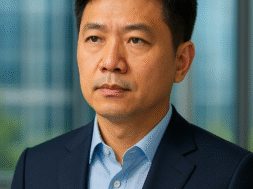

Mark Zuckerberg Doubles Down on AI Investments: “The Returns Are Already Showing”

Meta CEO Mark Zuckerberg has once again defended the company’s aggressive push into artificial intelligence, saying that heavy spending now will drive massive long-term gains for the tech giant.

During Meta’s third-quarter earnings call, Zuckerberg addressed the company’s soaring AI expenditures — including a $14.3 billion investment in Scale AI — part of a broader strategy to transform its AI division, now rebranded as Superintelligence Labs.

Critics have raised concerns that Meta, alongside rivals like OpenAI, Microsoft, and Alphabet, could be fueling an AI investment bubble. But Zuckerberg made it clear that Meta’s approach is deliberate, strategic, and already yielding results.

“We’re seeing a clear pattern — and it’s becoming evident that Meta will need even more computing power than we initially projected,” Zuckerberg said. “Making larger investments here is very likely to be profitable over time.”

To support its growing AI ambitions, Meta has been expanding its data centers and signing cloud infrastructure partnerships with companies including Oracle, Google Cloud, and CoreWeave.

Zuckerberg emphasized that even if Meta builds more capacity than it needs, the infrastructure can be repurposed to enhance Meta’s recommendation systems, ad delivery, and app performance — ensuring long-term value creation.

“If we overinvest in AI infrastructure, we can still use that capacity profitably across our family of apps and ads,” he noted.

Meta now expects its capital expenditures (CapEx) for 2025 to fall between $70 billion and $72 billion, slightly up from its prior forecast of $66–$72 billion. The company’s peers are following suit — Alphabet raised its spending outlook to $91–$93 billion, while Microsoft projected accelerated CapEx growth heading into 2026.

Despite Meta’s AI-driven optimism, its stock slipped 8% in after-hours trading, while Alphabet gained 6%, and Microsoft dipped 3%.

Zuckerberg hinted at the possibility of offering surplus computing power to third parties if Meta’s infrastructure capacity ever exceeds internal needs, though he downplayed any immediate plans to do so.

“If we ever reached a point of overbuilding, that would be an option,” he said. “But even in the worst case, we’d simply grow into that capacity over time.”

Meta’s advertising business — the company’s financial backbone — continues to perform strongly, thanks in large part to the efficiency and precision of its AI-powered ad tools.

“We’re already seeing strong returns from our AI investments in the core business,” Zuckerberg said. “That gives us confidence to keep investing aggressively and ensure we don’t underinvest.”

In the third quarter, Meta reported $51.24 billion in revenue, up 26% year-over-year, beating analyst expectations of $49.41 billion. The result marks Meta’s fastest growth rate since early 2024, underscoring the tangible benefits of its AI-first strategy.