Gold prices jumped over 1% on Monday, reaching their highest level in five weeks as both the U.S. dollar and Treasury yields declined. The rise comes amid growing uncertainty over a looming August 1 deadline for countries to finalize trade deals with Washington or face new tariffs.

Spot gold climbed 1.3%, hitting $3,394.23 per ounce by 2:34 p.m. ET, while U.S. gold futures closed 1.4% higher at $3,406.40. The U.S. dollar index slipped by 0.6%, making gold more appealing to buyers using other currencies. Meanwhile, benchmark 10-year U.S. bond yields dropped to their lowest in more than a week.

“Market uncertainty tied to the upcoming trade deadline is lending strong support to gold,” said David Meger, head of metals trading at High Ridge Futures.

European Union officials are reportedly preparing broader retaliatory measures, as hopes for a favorable trade pact with the U.S. diminish. On the monetary policy front, traders are pricing in a roughly 59% probability of a Federal Reserve rate cut in September, based on CME’s FedWatch data.

U.S. Treasury Secretary Scott Bessent recently questioned the structure of the Federal Reserve, adding to speculation around potential leadership changes, including the possible replacement of Fed Chair Jerome Powell.

Gold, traditionally a safe haven during times of uncertainty, typically benefits from lower interest rates.

In other metals, silver advanced 2.1% to $38.99 per ounce. Platinum rose 1.4% to $1,440.75, and palladium gained 2.1% to $1,266.04.

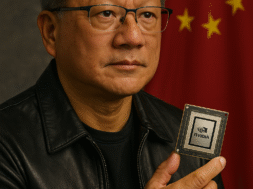

Data also revealed that China, the world’s top gold consumer, imported just 63 metric tons of gold last month—the smallest quantity since January—while its platinum imports dipped by 6.1% in June.