Gold Steadies as Traders Brace for Key U.S. Inflation Numbers

Gold prices inched higher on Tuesday, recovering slightly from the previous session’s steep drop, as investors kept their eyes on upcoming U.S. inflation data that could influence the Federal Reserve’s interest rate path. Spot gold rose 0.2% to $3,349.13 per ounce by 0904 GMT, while U.S. gold futures for December delivery held steady at $3,398.90. The gap between COMEX front-month futures and London spot prices—nearly $40 an ounce last Friday—has now narrowed, though analysts caution this alignment may prove short-lived if uncertainty returns.

Markets are awaiting the U.S. Consumer Price Index due at 1230 GMT, followed by producer price data on Thursday. A Reuters poll suggests core CPI likely rose 0.3% in July, bringing the annual rate to 3%, still above the Fed’s 2% target. ANZ’s Soni Kumari noted that if inflation surprises on the downside—especially after recent weak labor figures—expectations for a rate cut could strengthen, supporting gold prices. Current market bets point to an 85% probability of a cut next month.

Beyond short-term data, attention is turning to the Fed’s leadership as Chair Jerome Powell’s term ends next May. Former President Donald Trump, who has repeatedly pushed for deeper cuts, is fueling speculation over Powell’s successor. Meanwhile, Trump has extended the tariff truce with China by another 90 days.

In other precious metals, spot silver gained 0.6% to $37.81 per ounce, platinum advanced 0.8% to $1,336.84, and palladium climbed 1.5% to $1,152.68.

Related posts:

- Gold Surges to 5-Week Peak as Dollar Weakens, Trade Uncertainty Sparks Investor Rush

- Gold Could Surge to $4,000 as U.S. Trust Wavers – WisdomTree Analyst Warns

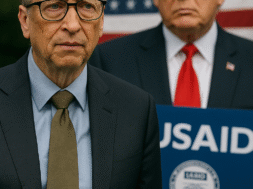

- Bill Gates Slams Foreign Aid Cuts: “Lives Are at Stake — It’s Not Too Late to Act”

- Spotify Tumbles 11% as Growth Misses Expectations Despite User Surge