Bitcoin Soars as Trump Greenlights Crypto Access in 401(k) Retirement Plans

The cryptocurrency market surged on Thursday amid growing excitement that Bitcoin and other digital assets may soon become part of 401(k) retirement portfolios.

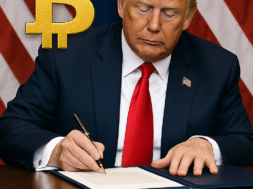

Former President Donald Trump is expected to sign an executive order that paves the way for retirement accounts to invest in alternative assets — including private equity, real estate, and cryptocurrencies.

Bitcoin gained nearly 1%, climbing back above the $116,000 mark for the first time since late July, while Ethereum jumped almost 4%, hitting a one-week high.

Although crypto-related stocks slightly pulled back during the afternoon market slowdown, names like Coinbase and Galaxy Digital remained up about 1.5%, and Bitmine Immersion — tied to Ethereum treasuries — rose nearly 4%.

Allowing Bitcoin in American retirement plans has long been seen as a key milestone for mainstream adoption. With the U.S. retirement market valued at $43 trillion — $9 trillion of which sits in 401(k) plans — the move could significantly widen crypto’s reach and shift investment patterns toward long-term digital asset holdings. The global crypto market cap currently stands around $4 trillion.

“This opens the gates to a massive capital pool,” said Galaxy CEO Michael Novogratz in a Thursday interview. “When crypto becomes a standard offering through familiar platforms like Fidelity or T. Rowe Price, it naturally draws more people into the space.”

Fidelity pioneered this concept back in 2022, offering Bitcoin within retirement plans, though adoption remained slow due to high interest rates, regulatory uncertainty, and investor skepticism.

The upcoming executive order — initially reported by Bloomberg — marks another bold step in the Trump administration’s broader push to position the U.S. as a global hub for digital finance. Just last month, Trump signed the GENIUS Act, officially establishing the first federal law recognizing stablecoins in the country.