Bitcoin Retreats to $115000 as Inflation Jitters Spark $500M Crypto Sell-Off

The cryptocurrency market kicked off the week on a volatile note, with more than half a billion dollars in leveraged positions wiped out amid renewed macroeconomic worries. Bitcoin slipped 2% to $115,255 after briefly plunging to $114,706, just days after setting a new all-time high of $124,496. Ether also pulled back 4% to $4,283, retreating from its near-record levels around $4,800. The drop came after hotter-than-expected U.S. wholesale inflation data fueled doubts over whether the Federal Reserve will move ahead with a rate cut in September.

According to CoinGlass, liquidations over the past 24 hours totaled about $576 million across 133,643 traders, including $124 million in bitcoin and $184 million in ether positions. Forced selling to cover margin calls added pressure, accelerating the downturn.

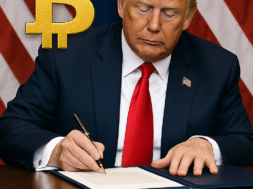

Sentiment also cooled following Treasury Secretary Scott Bessent’s clarification that the strategic bitcoin reserve announced in March by President Donald Trump will rely solely on government-forfeited coins, with no immediate plans to purchase more through new funding measures.

Major cryptocurrencies tracked broader weakness, with the CoinDesk 20 index down 3.7%. Crypto-linked stocks slid as well, with Bitmine Immersion tumbling 8%, newly listed exchange Bullish off 7%, and Coinbase and Circle both easing 2%.

Looking ahead, traders are eyeing the Fed’s annual Jackson Hole symposium and upcoming jobless claims data for policy signals. Despite the latest pullback, analysts argue the decline represents a natural cooldown rather than a crisis, with institutional support from crypto ETFs and corporate buyers still intact. Bitcoin- and ether-linked ETFs posted heavy inflows last week, with ETH funds recording a record $2.9 billion—marking their 14th consecutive week of net inflows.