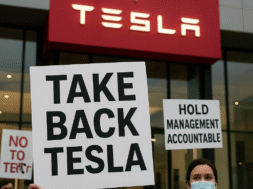

“Take Back Tesla” Campaign Pushes Shareholders to Block Elon Musk’s $1 Trillion Pay Deal

Just ahead of Tesla’s quarterly earnings release, a powerful coalition of labor unions and corporate accountability groups has launched a campaign challenging Elon Musk’s record-breaking $1 trillion compensation package.

The initiative, called “Take Back Tesla,” is led by organizations including the American Federation of Teachers and Public Citizen. The campaign’s newly launched website urges Tesla shareholders to vote against Musk’s proposed pay deal, arguing that it grants him excessive control and rewards distraction rather than performance.

Tesla’s board introduced the historic pay plan in September, saying it would help secure Musk’s leadership for the next decade. However, critics argue the plan is “outrageous” and fails to require Musk to focus more on Tesla than his other ventures, such as SpaceX, xAI, and X (formerly Twitter).

The coalition’s website also calls on public pension funds and institutional investors to reject the plan. “This is our money,” the campaign states, “and we must demand accountability from those investing it on our behalf.”

Additional groups backing the campaign include Americans for Financial Reform, People’s Action, Communication Workers of America, Stop the Money Pipeline, and watchdog group Ekō.

The Delaware Court of Chancery previously ruled that Musk’s 2018 $56 billion pay package was improperly approved, citing conflicts of interest and a lack of transparency. Musk has since appealed to the Delaware Supreme Court, while simultaneously pushing for the new plan that would add 12% to his ownership stake over the next decade.

Some major public investors, including New York City Comptroller Brad Lander, who manages over $300 billion in pension assets, have voiced strong opposition. “Tesla’s board is far from independent,” Lander said. “This package looks more like a ransom demand than a reward for performance.”

Despite recent rebounds in Tesla’s stock, the company still trails behind other major tech firms in 2025. Analysts expect Tesla’s upcoming quarterly report to show 4.7% year-over-year revenue growth, reaching roughly $26.37 billion, after two consecutive quarters of decline.