Coinbase CEO Slams Banks for Attacking Stablecoin Rewards With “Boogeyman” Claims

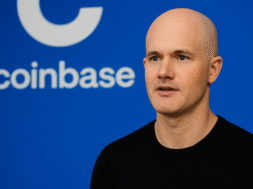

Coinbase CEO Brian Armstrong joined fellow crypto leaders on Capitol Hill this week in a heated policy battle with the banking industry — a fight that could impact trillions of dollars in deposits.

Banking advocacy groups are lobbying lawmakers to ban crypto exchanges from offering stablecoin rewards, arguing that such perks mimic traditional bank interest accounts. Coinbase currently pays 4.1% on USDC holdings, while Kraken offers 5.5%.

Armstrong pushed back, saying banks are using scare tactics:

“I’m not sure why banks want to bring this up again, but they should compete on a level playing field in crypto… The argument is just a boogeyman,” Armstrong said.

Under the newly passed GENIUS Act, exchanges cannot pay “interest” on stablecoins but can still offer reward programs. Banks, however, warn that this distinction could drive massive customer outflows. According to the Treasury Borrowing Advisory Committee, as much as $6.6 trillion could migrate from bank deposits to stablecoins.

John Court of the Bank Policy Institute argued that such a shift would weaken banks’ ability to lend and fuel economic growth. Armstrong countered, claiming the real motive is protecting the $180 billion banks make annually from payment services, insisting that “big banks are funding this fight behind the scenes.”

The debate has spilled into Congress. While the American Bankers Association urged lawmakers to close the “loophole,” crypto groups fired back, saying restrictions would unfairly favor traditional banks that fail to deliver competitive returns.

Some lawmakers consider the matter resolved. Sen. Cynthia Lummis (R-Wyo.), co-author of the pending crypto market structure bill, said the compromise in the GENIUS Act balanced both sides and “should not be reopened.”

As regulations continue to take shape, the clash over stablecoin rewards highlights the growing tension between traditional finance and digital assets — with consumer choice and banking profits hanging in the balance.