HSBC Unveils $3B Share Buyback as Profits Tumble 29% Amid Economic Uncertainty

HSBC, Europe’s largest bank, reported a sharp 29% decline in second-quarter profits, falling short of analyst forecasts, largely due to significant impairment charges. In a bid to reassure investors, the bank also announced a $3 billion share buyback.

For the quarter ending in June, HSBC posted a pre-tax profit of $6.3 billion — below the anticipated $6.99 billion — with total revenue reaching $16.5 billion, narrowly missing expectations. Operating expenses surged by 10% year-on-year, driven by restructuring costs and ongoing investments in digital infrastructure.

Shares listed in Hong Kong slipped 2.71% following the earnings release.

Group CEO Georges Elhedery pointed to rising geopolitical and economic pressures — including widespread tariffs and fiscal weaknesses — that are fueling market instability and complicating inflation and interest rate projections. He acknowledged that even before certain tariffs are enforced, trade disruptions are already reshaping global economic dynamics.

Despite these headwinds, HSBC remains confident in its ability to navigate the uncertainty, although it admitted that its return on tangible equity (RoTE) could fall below its targeted mid-teen range in the years ahead. The bank also warned that lending activity is expected to stay subdued through year-end.

On a brighter note, HSBC sees continued promise in its wealth management arm and anticipates double-digit annual growth in fee and other income from this division over the medium term.

As part of its broader restructuring strategy, HSBC is scaling down parts of its investment banking operations outside of Asia and the Middle East. Reports indicate that several roles in its German equities team will be eliminated. This downsizing is in line with a strategic overhaul introduced last year, which included splitting operations into Eastern and Western markets to trim costs — expected to save $300 million in 2025 alone.

Earlier this year, the bank confirmed plans to exit its mergers and acquisitions business, along with sections of its equities unit in Europe and the Americas.

While CEO Elhedery continues to push for cost-efficiency and a streamlined focus on core regions, the group is also facing a leadership transition. Chairman Mark Tucker is set to step down in September, adding another layer of change for the global banking powerhouse.

Related posts:

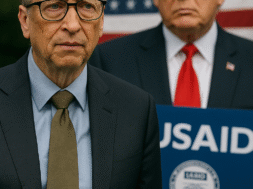

- Bill Gates Slams Foreign Aid Cuts: “Lives Are at Stake — It’s Not Too Late to Act”

- Nvidia CEO Plays Diplomatic Balancing Act, Says China Doesn’t Rely on U.S. AI Chips for Military

- Trump Vows Support for Elon Musk, Denies Plans to Cut Billions in Federal Subsidies

- Spotify Tumbles 11% as Growth Misses Expectations Despite User Surge