Apple Stock Soars to 5-Year High After White House Push for U.S. Manufacturing

Apple shares surged 13% this week, marking their strongest weekly rally in over five years, following CEO Tim Cook’s appearance at the White House alongside President Donald Trump on Wednesday. The stock closed Friday at $229.35, up 4% for the day, adding more than $400 billion to Apple’s market capitalization, which now stands at $3.4 trillion. This makes Apple the third most valuable company in the world, trailing only Nvidia and Microsoft, and ahead of Alphabet and Amazon.

During the White House event, Cook announced Apple’s commitment to invest $100 billion in U.S.-based companies and locally produced components over the next four years. The pledge, particularly toward sourcing American-made chips, was met with approval from Trump, who noted the company would avoid potential tariffs that could significantly raise the price of imported components.

Apple had previously warned of more than $1 billion in possible tariff expenses this quarter if no policy changes occurred. Analysts applauded Cook’s strategic handling of the situation, calling it a strong demonstration of leadership amid trade uncertainty. This positive momentum follows Apple’s recent quarterly report showing a 10% boost in overall revenue and a 13% rise in iPhone sales.

Related posts:

- Tim Cook’s Masterclass: How Apple Dodged U.S. iPhone Demands While Winning Trump Over

- Trump Ally Slams Tim Cook for Delays in Shifting iPhone Production from China

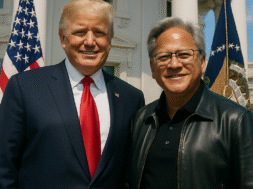

- Trump Meets Nvidia CEO After $4 Trillion Milestone Amid AI Chip Export Tensions

- Bullish Ups IPO Target to Nearly $1B, Eyes $4.8B Valuation Amid Crypto Market Momentum